35+ Check how much mortgage you can get

How Much Will You Earn. But once your lender sees your income is high and sustainable enough you can get approved.

Rent By Owner Guide Making A Vacation Rental Check Out Checklist Vacation Rental Management Beach House Rental Vacation Rentals By Owner

Other debt obligations like student loans and car payments are factored in when you apply for a loan but you should also consider your personal expenses such as groceries and entertainment when determining how much you want to spend.

. There are a total of 250 working days for the calendar year of 2022. Cook is an expert in personal finance and health and a ghostwriter and editor of consumer books. In general obtaining a mortgage when youre self-employed can be more challenging.

Learn what that means for your retirement plan. Over the course of a 30-year loan the difference between a 400 interest rate and a 375 interest rate is. A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property.

Alternatively you can use Credit Ladder which reports your rent payments for free to either Experian Equifax or TransUnion you choose which one. 1 the average discounted discretionary rate at the Big 6 banks as tracked by Butler Mortgage 2 the average broker rate as tracked by MortgageDashboardca and 3 the lowest conventional full-featured 5-year fixed rate at Butler Mortgage as of March 14 2017. Real Estate Reality Check Building Wealth Live.

There are two different ways you can repay your mortgage. How Much Should You Contribute To Your 401K How To Optimize Your 401K How To Roll Over Your 401K Roth IRA Or. Thats about two-thirds of what you borrowed in interest.

Whether youre paying cash leasing or financing a car your upper spending limit really shouldnt be a penny more than 35 of your gross annual income. On a 30-year mortgage with a 4 fixed interest rate youll pay over the life of your loan. Yes you can get approved for a mortgage when you owe a federal tax debt to the IRS.

Borrowers are still responsible for property taxes or homeowners insuranceReverse mortgages allow older. I can pay my money order check. While there are no shortcuts for building up a solid credit history and score there are some steps you can take that can provide you with a quick boost in a short amount of time.

If you instead opt for a 15-year mortgage youll pay over the life of your loan or about 46 of the interest youd pay on a 30-year mortgage. With a capital and interest option you pay off the loan as well as the interest on it. How Much Do You Need To Have Saved For Retirement.

Learning how to get the best mortgage rate is an important part of getting a home loan. The mortgage should be fully paid off by the end of the full mortgage term. It is a comparison of the average advertised Big 6 bank special offer rate versus.

Our 4 step plan will help you get a home loan to buy or refinance a property. My mortgage co informed me. If you want to get really precise and find out exactly much youll make for the year in 2022 at an hourly rate of 30 youll need to know how many actual working days total days minus public holidays and weekends there are in any given year.

Monthly Capital Interest Payment Breakdown. Normally do a 30-day payoff quote by means I request -fax email US mail. Capital and interest or interest only.

Am ready to payoff the mortgage next month after not 3 yrs but 35 yrs. With an interest only mortgage you are not actually paying off any of the loan. Call 855 610-1112 Email.

You can get them added to the files of all three credit reference agencies if you want but this costs 5 a month. The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments. Lenders are concerned with the viability of your business and whether you can sustain monthly mortgage payments.

Your debt dont miss any bills and wait until your credit score disappears before trying to buy a house. After the period is over the ownership of the house is transferred to. She has 15 years of experience as an executive editor or editor-in-chief.

When you apply for a mortgage personal loan or private student loan you wont have to worry about meeting a lenders minimum credit score requirements with a score of 800. On a 30-year mortgage with a 4 fixed interest rate youll pay over the life of your loan. This is the first time you get to say to someone from your mortgage company Wed like to pay off our mortgage today.

That means if you make 36000 a year the car price shouldnt exceed 12600. Heres How Much Car You Can Afford Follow the 35 Rule. Financial planners often suggest replacing about 80 of your pre-retirement income to keep the same lifestyle once you retire.

The Beginners Guide To Saving For Retirement. Here a house that the senior citizen owns is mortgaged with a bank which pays a predetermined amount over the period of the mortgage. Usually the longest term fixed mortgage you could normally get was five years.

Itll be much easier for you to get a mortgage with no credit score than a low onetrust us. Find A Financial Advisor. Reverse mortgage An additional source of income for senior citizens other than the corpus they have amassed can be a reverse mortgage.

In fact some consumers may even see their credit scores rise as much as 100 points in 30 days. Your total interest on a 100000 mortgage. For instance if you locked in a mortgage for 30 days and after a week you realize that it will take 35 days to close you may be able to re-lock the same loan with a new 30-day period of time.

As long as you. You need to prove you have a reliable income source. Your total interest on a 250000 mortgage.

Thats about two-thirds of what you borrowed in interestIf you instead opt for a 15-year mortgage youll pay over the life of your loan or about half of the interest youd pay on a 30-year mortgage. Savings is over five years. For 5 a month itll report your rent payments to all three of.

Many experts recommend spending a maximum of 28 to 35 percent of your pre-tax income on your housing expenses. Use our mortgage affordability qualification calculator to estimate how much you can qualify for based on your current income.

Open House For New Building Flyer Google Search Flyer Postcard Template Flyer Template

Additional Mortgage Payment Savings Infographic Househunt Real Estate Blog Mortgage Payment Savings Infographic Mortgage Info

How To Deal With Paper Clutter Paper Clutter Clear Paper Declutter

Pin Auf Home Hacks Organization

Mortgage Rate Losing Streak Loses Steam Mortgage Rates Brain Diseases Mortgage

Free 35 Printable Statement Forms In Pdf Excel Ms Word

35 Issues To Make With Play Dough Faux Create Be Taught In 2022 Playdough Teaching I Respect You

Kick Away Your Home S Winter Blues With Indoor Plants Conservatory Garden House Plants Indoor Conservatory Design

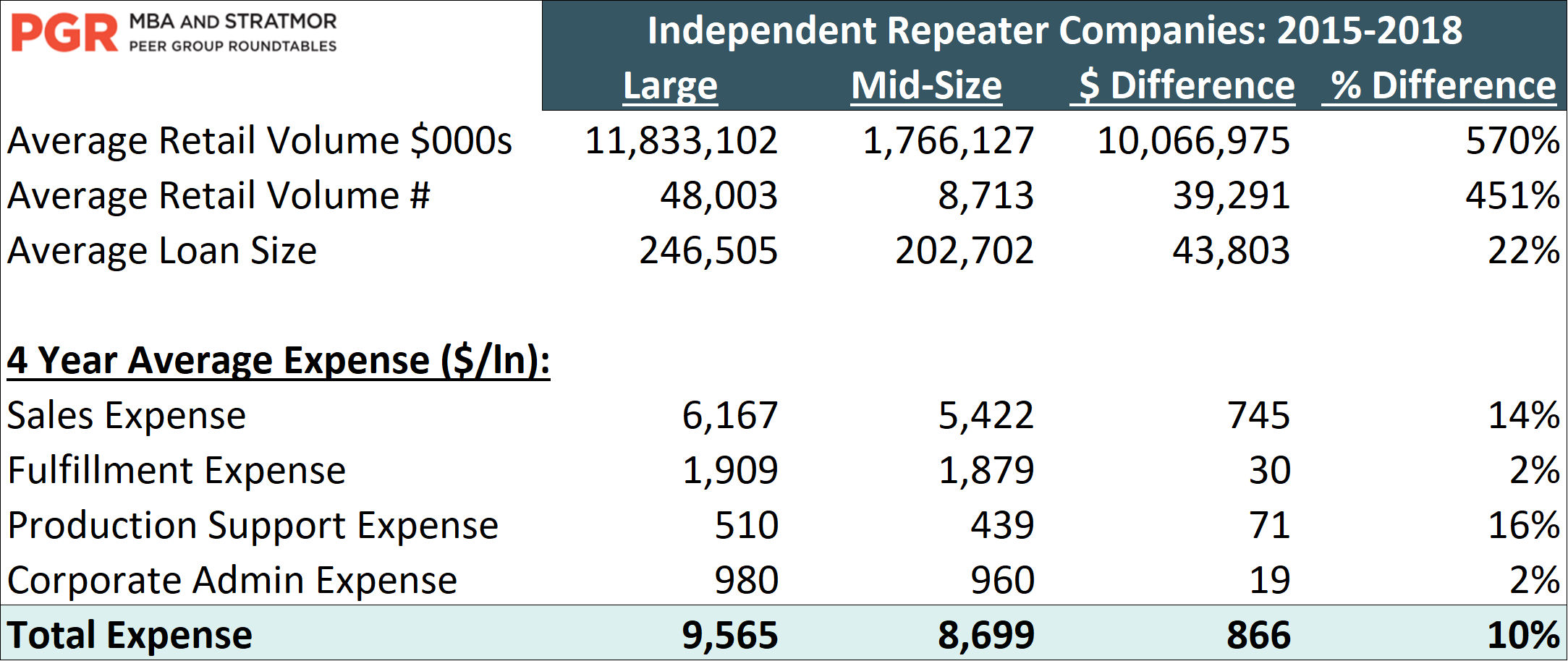

Myth Busters Dispelling Common Myths In Mortgage Banking Stratmor Group

Living Room Apartment Living Room Inspiration Design Ideas With Black Leather Sof Small Apartment Living Room Living Room Decor Apartment Apartment Living Room

Print Ad Templates Indesign Illustrator Publisher Word Mortgage Humor Mortgage Lenders Mortgage Tips

Access Of Louisiana Federal Credit Union Can Help You Get The Car Loan You Need Today Find Out More Inform Car Loans Bad Credit Car Loan Personal Loans Online

35 Real Estate Logos Ai Eps Real Estate Logo Design Real Estate Logo Web Design Freebies

35 Where To Find Solarium Room Pecansthomedecor Com Solarium Room Glass Room Solarium Ideas

Lbc Mortgage Solutions Google Mortgage Rates Fixed Rate Mortgage Refinance Mortgage

10 Ways To Improve Your Chances Of Approval On Your First Mortgage Improve Yourself Improve Mortgage

Free 35 Loan Agreement Forms In Pdf